All Categories

Featured

2 individuals acquisition joint annuities, which provide a surefire income stream for the rest of their lives. When an annuitant passes away, the rate of interest made on the annuity is handled differently depending on the kind of annuity. A kind of annuity that quits all payments upon the annuitant's fatality is a life-only annuity.

If an annuity's marked beneficiary passes away, the outcome depends on the certain terms of the annuity agreement. If no such recipients are marked or if they, also

have passed have actually, the annuity's benefits typically advantages commonly the annuity owner's proprietor. If a recipient is not called for annuity advantages, the annuity proceeds generally go to the annuitant's estate. Annuity cash value.

Are inherited Retirement Annuities taxable income

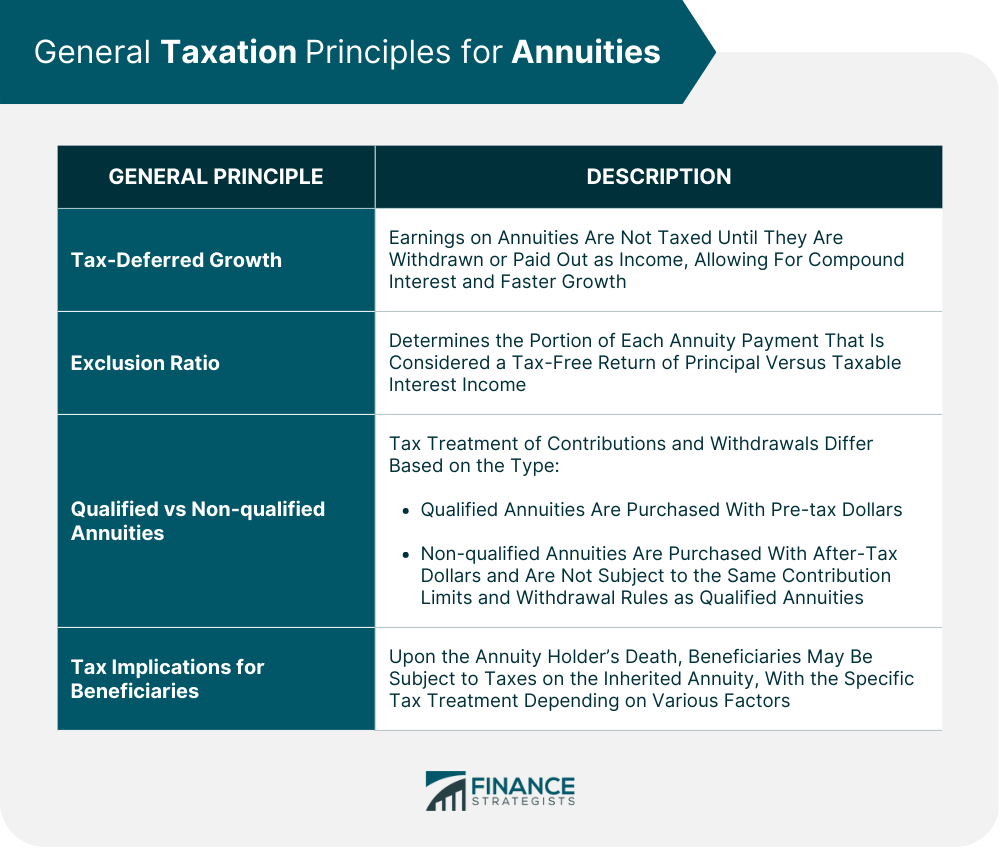

Whatever part of the annuity's principal was not already exhausted and any revenues the annuity accumulated are taxed as revenue for the beneficiary. If you inherit a non-qualified annuity, you will just owe taxes on the incomes of the annuity, not the principal utilized to buy it. Due to the fact that you're obtaining the entire annuity at once, you need to pay tax obligations on the entire annuity in that tax obligation year.

Latest Posts

Breaking Down Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Fixed Annuity Vs Equity-linked Variable Annuity Defining Variable Vs Fixed Annuities Benefits of Fixed Vs Var

Decoding Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Annuities Variable Vs Fixed Defining Annuities Variable Vs Fixed Pros and Cons of Variable Annuity Vs Fixed Indexed Annuit

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Fixed Vs Variable

More

Latest Posts